capital gains tax rate increase

Those who believe the rates should be higher argue that low capital gains. The tax rate paid on most capital gains depends on the income tax bracketThose with taxable income of less than 80801 married.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Currently the maximum capital gains rate is 20.

. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax. From 1 August 2013 residents also were obligated to pay an additional 6 of health insurance tax EHO on their capital gain. Giving a property.

Capital gains are profits you make from selling an asset. Short-term capital gains tax rate. All short-term capital gains are taxed at your regular income tax rateFrom a tax perspective it usually makes sense to hold onto investments for more than a year.

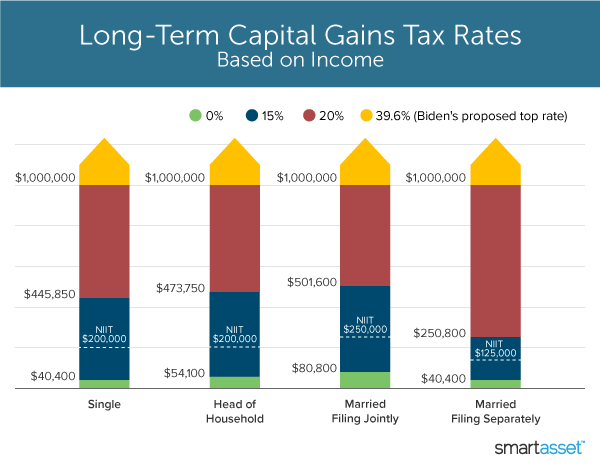

Long-term capital gains are when you hold an investment for more than a year after purchased. Capital gains tax rates have fallen in recent years after peaking in the 1970s. Bracket levels adjusted for inflation each year.

Rate For Single Individuals For Married Individuals Filing Joint Returns. States due to state and local capital gains taxes leading to a combined average rate of over 48 percent compared to about 29 percent under current law. Although it is referred to as capital gains tax it is part of your income tax.

Typical assets include businesses land cars boats and investment securities such as stocks and bonds. Capital gains tax. Proponents of maintaining a relatively low capital gains tax rate argue that lower rates make investing more accessible to more people and stimulate economic growth.

Selling one of these assets can trigger a taxable event. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels. What is a capital gain.

The tax rate on capital gains from securities held in such an account is 10 after a 3-year holding period and 0 after the accounts maximum 5 years period is expired. Short-term capital gains are treated as income and are taxed at your marginal. If your income falls in the 40400441450 range your capital gains tax rate as a single person is 15 in 2021.

Release dates for tax bracket inflation adjustments vary. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. Long-term capital gains tax rate.

Additional State Income Tax Information for Ohio. It is not a separate tax. If you have a capital gain it will increase the tax you need to pay.

Understanding the capital gains tax rate is an important step for most investors. CGT is paid on the increase in the propertys value since it was bought less expenses such as stamp. You may want to work out how much tax you will owe and set.

The income range rises slightly to. You report capital gains and capital losses in your income tax return and pay tax on your capital gains. This often requires that the capital gain or loss.

What are 2021 tax rates. The 6 health insurance tax on capital gains was abolished on 1 January 2017. The maximum capital gains are taxed would also increase from 20 to 25.

They are generally lower than short-term capital gains tax rates. This new rate will be effective for sales that occur on or after Sept. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

Your short-term capital gains are taxed at the same rate as your marginal tax rate tax bracket. Short-term capital gains are when you buy an investment and sell it in a year or less. You can get an idea from the IRS of what your tax bracket might for 2021 or 2022.

13 2021 and will also apply to Qualified Dividends. Capital gains tax is the tax paid on profits you make from selling an investment for more than it was purchased for. Rates would be even higher in many US.

2021 Federal Income Tax Brackets and Rates.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How To Calculate Capital Gains Tax H R Block

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Definition 2021 Tax Rates And Examples

How Do Taxes Affect Income Inequality Tax Policy Center

What S In Biden S Capital Gains Tax Plan Smartasset

How Do Taxes Affect Income Inequality Tax Policy Center

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post

Selling Stock Are There Tax Penalties On Capital Gains The Motley Fool

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)